A Simple Guide to Payroll Deductions in Canada (Step-by-Step)

Payroll Deductions for Sole Proprietors in Canada

How to pay yourself through salary (not dividends), without becoming overwhelmed If you’re a small-business owner doing your own books, payroll deductions can feel like a maze. This post walks you through what you need to know, step by step—using a simplified example so you can see how it all works in practice.The Challenge

When you're a sole proprietor (not incorporated), paying yourself isn’t as simple as writing a cheque: you’re your own employee, and technically you need to treat payments to yourself like salary. That means withholding and remitting certain deductions. Some caveats before we dive in:- We won’t get into the differences between salary vs dividend (that’s more relevant if you incorporate). Here, we’ll assume you are not incorporated and want to pay yourself via salary.

- Salary in this context is somewhat flexible—since your business revenue may fluctuate, your payments to yourself might also fluctuate.

- For clarity in our example, let’s assume you plan a salary of $50,000 CAD per year. We’ll treat that as your baseline to illustrate deductions, remittances, and obligations.

Why Pay Yourself as an Employee

- Predictable income for personal budgeting. Regular salary beats irregular owner draws for household planning.

- Consistent tax withholding. CPP/EI/income tax are withheld each pay—reducing year-end surprises.

- CPP retirement contributions. Staying current improves lifetime pension eligibility.

- Program eligibility. EI special benefits (if elected) are easier to administer with payroll.

- Professional records. Pay slips/remittances help with credit applications, grants, and a future transition to incorporation.

Scenario Summary

You’ll set a $50,000 salary, run semi-monthly pay cycles, deduct required payroll amounts (CPP, EI, income tax), remit employer and employee portions, and reconcile at year end. Below you’ll find what to know and how to calculate each piece.What You Need to Know

- CPP (Canada Pension Plan): employee + employer contributions (employer matches).

- EI (Employment Insurance): employee + higher employer portion.

- Income tax withholding: federal + provincial, reduced by TD1 personal credits.

- Ceilings: CPP and EI stop after annual maximums are reached.

- Year-end reporting: T4s, records kept ~6 years.

- Provincial nuances: e.g., Quebec uses QPP instead of CPP.

Payroll Remittance Deadlines

Once you begin withholding payroll deductions, you must remit both the employee and employer portions (income tax, CPP, and EI) to the CRA by specific deadlines. Missing these dates can lead to interest charges and late-payment penalties, so it’s worth understanding which schedule applies to you.

- New or small remitters: If your total average monthly deductions are $25,000 or less, payments are due by the 15th of the following month.

Example: Deductions from January pay periods are due by February 15. - Regular remitters: Once your total monthly withholdings exceed $25,000 but are below $100,000, you’ll typically remit twice per month — on the 15th and the last day of the month.

- Accelerated remitters: Large employers (>$100,000 average) remit up to four times per month. This won’t apply to most small businesses or sole proprietors.

For most small businesses, the first category (“monthly remitter”) is what you’ll fall under. You can submit your payments online through your CRA My Business Account using the Payroll Deductions (PD7A) form or through your financial institution’s online bill-payment system.

The CRA updates its remittance frequency thresholds periodically, so it’s best to confirm your status each year: CRA – When to Remit Source Deductions

How to Calculate Your Remittances

The CRA Payroll Deductions Online Calculator (PDOC) is the most reliable way to calculate payroll deductions. It reflects current rates/tables for CPP, EI, and income tax across provinces/territories and mirrors the approach CRA uses when reviewing payroll calculations.Calculator link: CRA Payroll Deductions Online Calculator

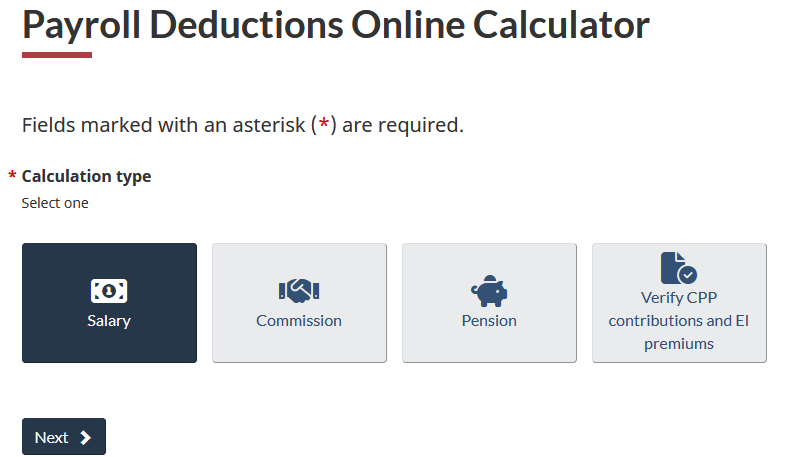

Step 1: Select “Salary” as the Calculation Type

Choose Salary. This treats the input as regular employment income—not a bonus/commission/retroactive payment.Screenshot of the CRA Payroll Deductions Calculator showing the “Salary” calculation type selected.

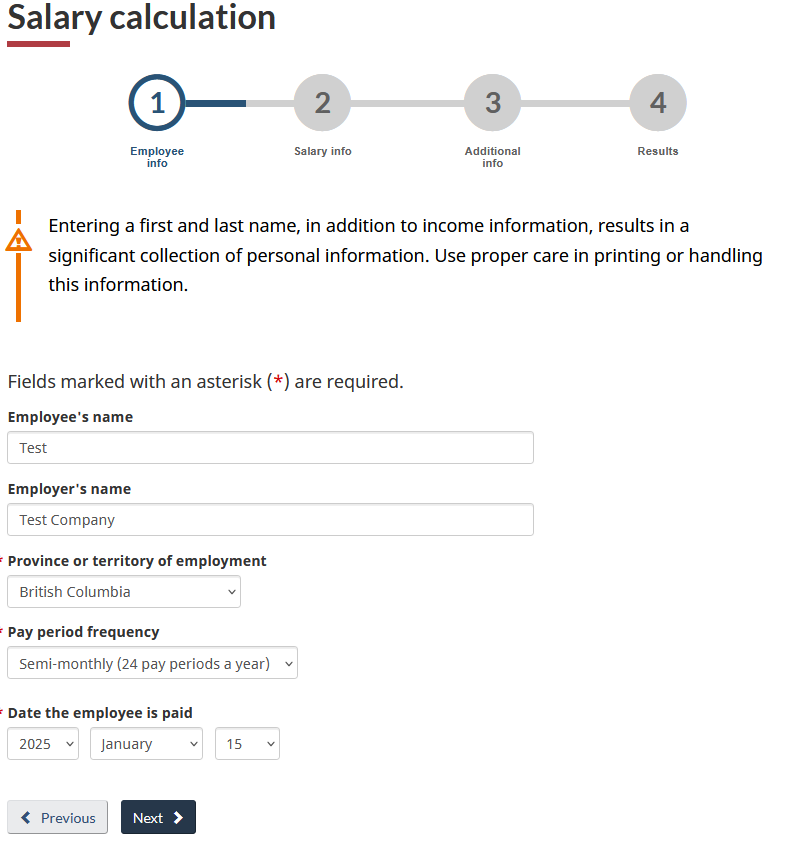

Step 2: Enter Employee Information

- Province/territory of employment (e.g., British Columbia for this example).

- Pay period frequency: Semi-monthly is a great balance (24 pays/year). Monthly can strain budgeting; bi-weekly adds 26 pays and occasional proration at year-end.

- Payment date: If salary begins Jan 1 and first pay is Jan 15, the tool calculates Jan 1–15 and continues forward.

Tip: Semi-monthly aligns nicely with household bills and CRA remittance rhythms.

Employee information screen in the CRA Payroll Calculator, where you set province, pay frequency, and first pay date.

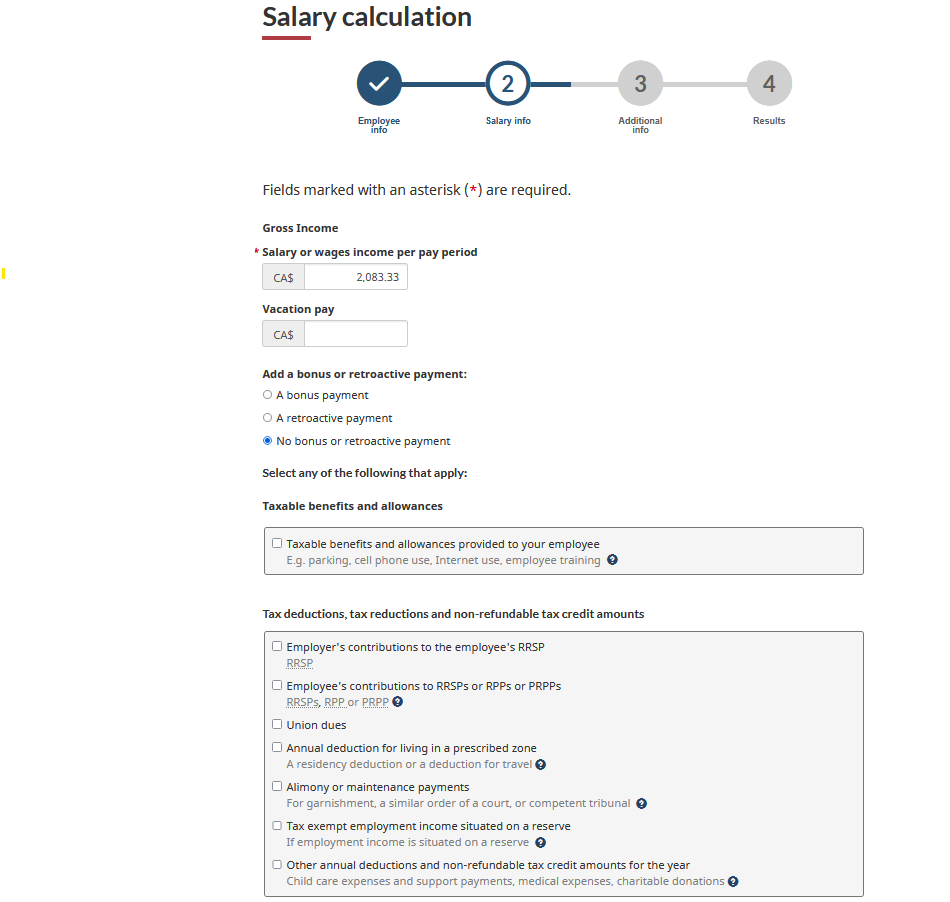

Step 3: Enter Salary Information

- Annual salary & pay periods: $50,000 with 24 periods gives $2,083.33 gross/pay.

- Vacation pay:

- Enter an amount if you’re paying out vacation in this period (annual payout or termination), adding vacation pay on top of regular salary, or paying a set % every paycheque (e.g., 4%).

- Leave blank if you accrue vacation but don’t pay it each period. In our example we leave it blank because you’re building the vacation liability internally and employees use paid time off later—no extra cash added to each cheque. This keeps payroll cash flow predictable, tracks vacation expense cleanly, and fits common “use it or lose it” policies.

- Benefits/deductions: Skip for this simple setup. If you add benefits later, include their taxable amounts each period.

Salary input section showing gross pay per period and vacation pay field left blank for accrual-only setups.

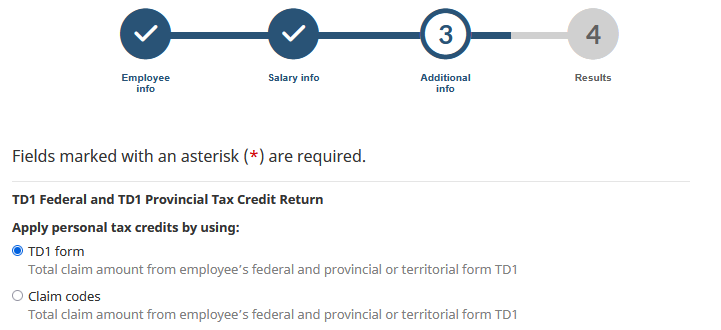

Step 4: Complete the “Additional Information” Section

Apply personal tax credits: Select TD1 form to apply the standard basic personal amounts (federal + provincial). CRA will reconcile any over/under-withholding on your T1 at year-end.

TD1 form selection screen used to apply basic personal tax credits automatically.

Canada Pension Plan (CPP): Leave defaults so the calculator assumes this is the only job and computes required contributions. Quick reference (2025): 5.95% employee + 5.95% employer; basic exemption $3,500; YMPE $71,300; max contribution $4,034.10 per side.

CPP contribution settings showing the default employee and employer rate fields

Employment Insurance (EI): Leave defaults unless a reduced rate applies. Quick reference (2025): 1.64% employee; 2.296% employer (1.4× employee); MIE $65,700; max contributions $1,077.48 (employee) / $1,508.47 (employer).

EI contribution section with standard 1.4× employer multiplier applied.

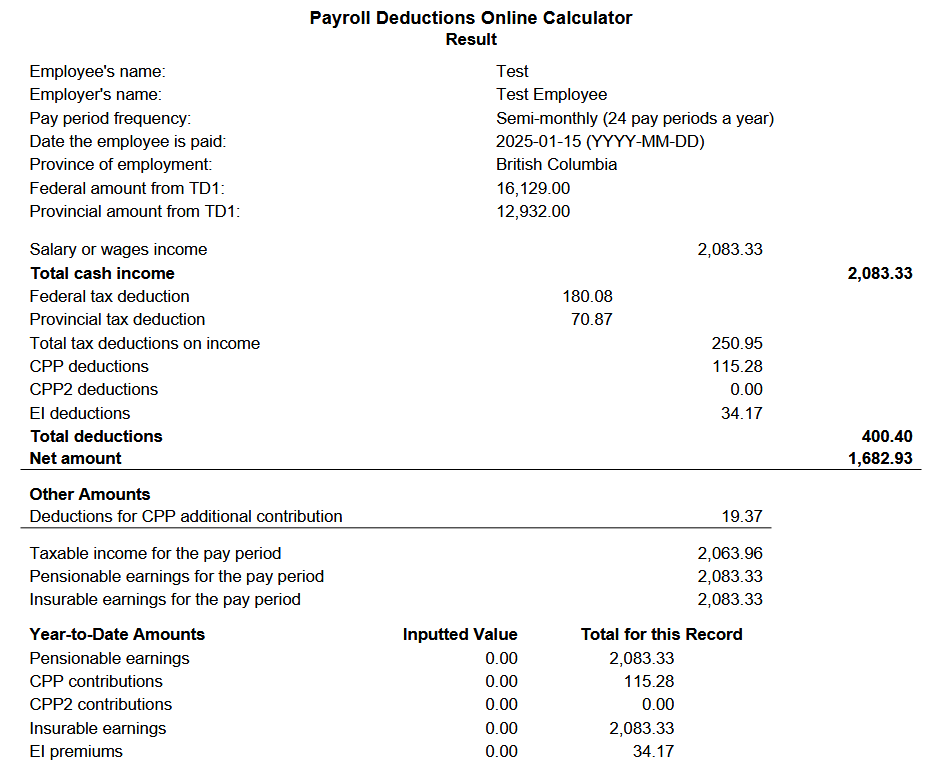

Step 5: Review the Results

You’ll see two summaries:

- Employee deductions summary: income tax, CPP, EI withheld from the $2,083.33 gross.

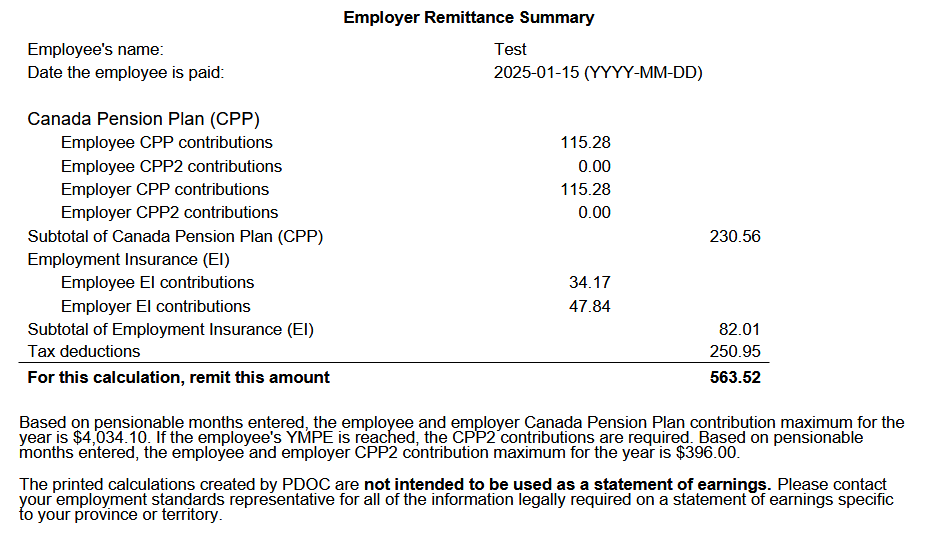

- Employer contributions summary: your CPP match + EI employer portion added to the remittance.

Because $50,000 is below CPP/EI maximums, each pay will look the same. Multiply per-pay amounts by 24 to estimate annual totals. If you approach the CPP/EI ceilings in a higher-income scenario, rerun the calculator near that point to stop deductions appropriately (overpayments are reconciled on your T1 but better avoided).

Summary of payroll deductions for the employee, showing CPP, EI, and income tax withheld.

Employer summary results showing total CPP and EI contributions to remit to the CRA.

Summary and Call to Action

You now have the roadmap to walk through payroll deductions—even as a sole proprietor paying yourself salary.

To recap:

- Paying yourself as salary means treating yourself as an employee for CPP, EI, and income tax withholding.

- Use the CRA calculator for per-pay calculations that reflect current rates.

- Track employer and employee portions, ceilings, and remittance schedules.

- Under straightforward assumptions (salary under thresholds), results are consistent each pay; complexity rises with benefits, multiple jobs, or hitting CPP/EI maximums.

If this still feels overwhelming—or if you have benefits, fluctuating income, or multiple employees—I can set this up for you. At Agate Bay Bookkeeping, I offer tailored payroll setup and compliance reviews so you can focus on your business, not the admin.

Ready to get it right from the start? Reach out and we’ll build a payroll system that fits your business, ensures compliance, and gives you peace of mind.

💡 Next week’s blog post: I’ll show you how to track these payroll deductions in a pre-formatted spreadsheet and the exact journal entries to make when entering payroll into QuickBooks Online. Stay tuned!